Corporate Governance

Basic approach and policy

The Group views corporate governance as a fundamental component of business management that serves as a system for monitoring and controlling corporate operations. We believe that when this function is weakened or lost, the risks of misconduct and business failure increase significantly.

The Basic Principles on Corporate Governance

As a listed company, we respect the following five basic principles of corporate governance. We will achieve sustainable growth and maximize corporate value through accurate and prompt management decisions as well as timely and appropriate execution of duties while enhancing the management check function and ensuring compliance (legal observance).

- Protect shareholder rights and ensure equality

- Build smooth relationships with stakeholders

- Create a comfortable work environment for employees

- Ensure timely and appropriate information disclosure and transparency

- Enhance management supervision and ensure accountability to shareholders of the Board of Directors and the Audit and Supervisory Board

We have also published our Basic Policy on Corporate Governance (PDF) on our website, which was formulated in accordance with the principles of the Corporate Governance Code.

As a member of society, the Group aims to build and strengthen trust-based relationships with all stakeholders, and to create new value and inspiration through a wide range of technologies that are not limited to flavors and fragrances, contributing to a richer and more fulfilling life.

To fulfill its social responsibilities, grow sustainably, and improve long-term corporate value, our Group needs to make decisions rapidly and execute business flexibly while responding to the changing management environment under a highly reliable and transparent management system.

Our Group regards corporate governance, which serves as the foundation of a highly reliable and transparent management system, as an important challenge and will continue to work on strengthening our governance system so that it remains effective.

Approach to executive compensation

The Company determined the policy on decisions regarding the remuneration, etc., of individual directors during a Board of Directors meeting held on April 16, 2021.

Policy on decisions regarding the remuneration, etc., of individual directors

a. Basic policy

As the basic policy for the remuneration, etc., of the Company’s directors, the remuneration system shall also be linked to shareholder returns so that it will adequately function as an incentive to increase motivation and morale for improving shareholder value and to continue to improve corporate value. Furthermore, the remuneration, etc., of individual directors shall be set at the appropriate level in light of their duties.

Specifically, the remuneration, etc., of internal directors shall include basic remuneration as fixed remuneration, bonus as performance-linked remuneration, and stock-based compensation stock option as non-monetary remuneration. The remuneration, etc., of outside directors shall be paid only as basic remuneration in light of their duties.

b. Policy on decisions regarding the basic remuneration (monetary remuneration), etc., of individuals (including the policy on deciding the time or conditions for granting remuneration)

As the fixed remuneration of the Company’s directors, basic remuneration shall be paid at a certain time every month.

The amount of remuneration payment for individual directors pertaining to basic remuneration (fixed remuneration) shall be determined based on the corresponding level for the position within the remuneration limit approved by the resolution of the General Meeting of Shareholders while taking into consideration the performance, financial condition, economic situation, market level, etc.

c. Policy on decisions regarding the details of performance-linked remuneration, etc., and non-monetary remuneration, etc., and the calculation method for the amount or number thereof (including the policy on deciding the time or conditions for granting remuneration)

The upper limit for the total amount of bonus payment, which is performance-linked remuneration, shall be determined within the remuneration limit approved by the resolution of the General Meeting of Shareholders. With consolidated ordinary profit as the indicator for performance-linked remuneration, the payment amount shall be calculated by multiplying the payment unit (which is obtained by multiplying the incentive corresponding to the rate of achievement of the consolidated ordinary profit plan) with the factor corresponding to the position of the director, while taking into account the performance evaluation of the director. This payment shall be made at a certain time every year.

Note that consolidated ordinary profit represents profit from overall management activities and is considered appropriate as an indicator to evaluate the performance of duties of directors. Therefore, consolidated ordinary profit shall be used as the indicator pertaining to performance-linked remuneration.

d. Policy on decisions regarding the details of non-monetary remuneration, etc., and the calculation method for the amount or number thereof (including the policy on deciding the time or conditions for granting remuneration)

As a stock-based compensation stock option, which is non-monetary remuneration, a share option that is granted by exercising the right at one yen for one share shall be granted once every year as a rule. Note that the number of options granted shall be determined based on the standard corresponding to the position within the remuneration limit approved by the resolution of the General Meeting of Shareholders.

e. Policy on decisions regarding the rate of the amount of fixed remuneration, performance-based remuneration, etc., or non-monetary remuneration, etc., to the amount of remuneration, etc., of individual directors

The remuneration, etc., of internal directors shall include basic remuneration (fixed remuneration), bonus (performance-linked remuneration), and stock-based compensation stock option (non-monetary remuneration). The remuneration, etc., of outside directors shall only include basic remuneration. The rate of payment of the remuneration of internal directors shall be set at the appropriate rate so that it will adequately function as an incentive to increase motivation and morale for improving shareholder value and to continue to improve corporate value, while taking into consideration the post, duties, and trends of other companies with the same business scale as the Company, etc., in a comprehensive manner.

f. Matters related to decisions regarding the remuneration, etc., of individual directors

The amount of remuneration, etc., of individual directors shall be determined by the Board of Directors meeting within the remuneration limit approved by the General Meeting of Shareholders in light of the details of the deliberation at the Compensation Committee, a voluntary committee. Note that the Compensation Committee shall include the representative director and outside directors to ensure the transparency and objectivity of decisions pertaining to remuneration.

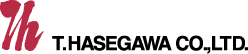

System

The Group will continue working to strengthen an effective corporate governance system, which serves as the foundation for a highly reliable and transparent management structure.

The Company adopted the Audit and Supervisory Board as its corporate governance system under the Companies Act of Japan. The Board of Directors makes important management decisions and supervises business execution, while auditors and the Audit and Supervisory Board, which are independent of the Board of Directors, audit the status of such business execution. We have also adopted the executive officer system and the group executive officer system to promote the appropriate division of roles between management and business execution, accelerate management decision-making, and strengthen business execution functions.

Furthermore, we have established three voluntary organs: the Strategy Committee*, Appointment Committee, and Compensation Committee*.

In FY2024, we held 12 meetings of the Board of Directors, where we made decisions on key management matters, including those required by laws and our Articles of Incorporation, as well as on business policies and budget planning. We also analyzed and evaluated monthly performance and deliberated from the perspectives of legal and statutory compliance and operational appropriateness.

*Strategy Committee: Flexibly deliberate on business execution, including the formulation of management strategies and key matters related to the operation of the Group.

*Appointment and Compensation Committee: Ensure transparency and objectivity in the selection of director candidates and the determination of their compensation.

Corporate governance structure

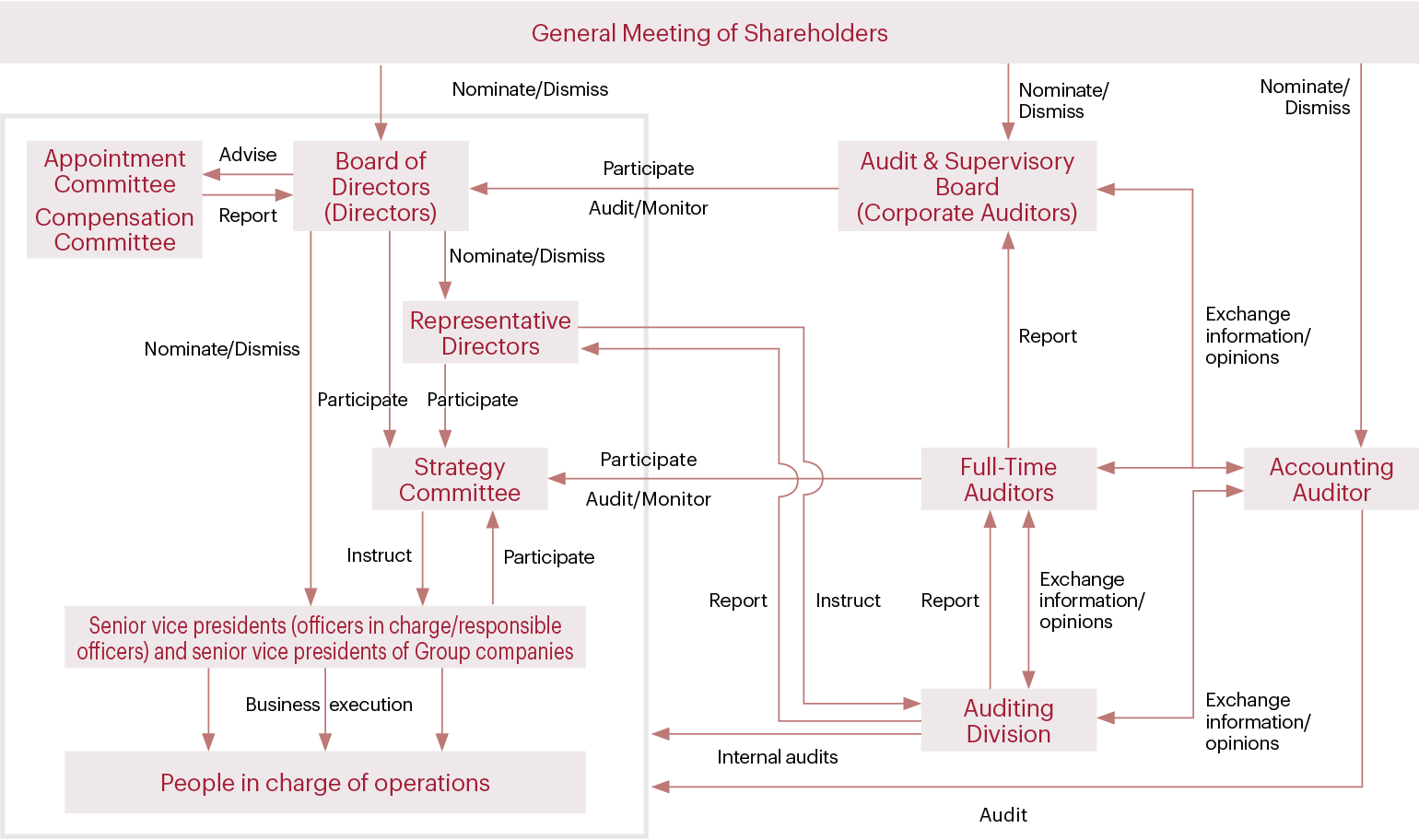

Diversity of directors and auditors

To achieve corporate governance that will serve as the foundation of a highly reliable and transparent management system, the Group has set the number of directors at 10 or less in accordance with the Articles of Incorporation, with an appropriate number of directors to ensure active discussion and deliberation and prompt decision-making. In nominating directors and auditors, we promote diversity among the Board of Directors by taking into consideration their personalities, insight, extensive knowledge of various fields, experience, professional background, gender, and internationality such as race, ethnicity, nationality, country of origin, and age, regardless of whether they are internal or external, with the aim of enhancing corporate value over the medium to long term.

Skill matrix of directors and auditors

(As of April 30, 2025)

Succession plan

The Group realizes that the planned development of successors to the representative director is important as a business strategy for continuing to improve our corporate value in the future. In accordance with the Basic Policy on Corporate Governance, we are working to develop successors in a planned manner so that candidates can gain experience while participating in management through business execution and attending important meetings, including Board of Directors meetings and the Strategy Committee. As a result, we are able to cultivate the abilities, experience, knowledge, skills, and other factors that are necessary to serve as a President & COO.

In order to ensure transparency and objectivity in the nomination of representative director candidates, relevant details are deliberated in the Appointment Committee (which is a voluntary committee comprised of the representative director and a majority of independent outside directors) and chaired by an independent outside director before they are reported to the Board of Directors. Based on reports and advice from the Appointment Committee, the Board of Directors continues to supervise the overall efforts for developing successors.

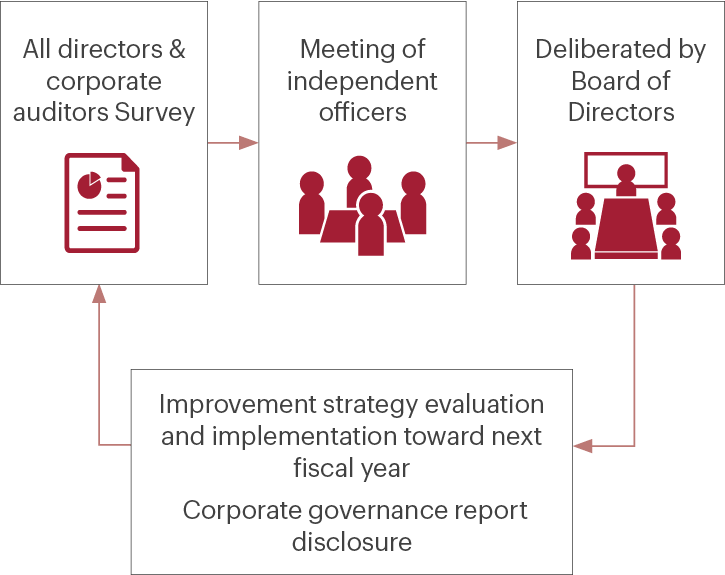

Evaluation of the effectiveness of the Board of Directors

Once each year, the Company’s Board of Directors analyzes and evaluates its effectiveness and discloses an overview of the results.

In FY2024, we conducted a questionnaire survey of all directors and auditors regarding the composition and operation of the Board of Directors, and the results of the survey were compiled, analyzed, and evaluated by the Board. As a result, we confirmed that the effectiveness of the Board is ensured.

Based on the results of this analysis and evaluation, in 2025, we will promote the sharing of materials that are easy to understand in terms of key points, as well as early reporting of information we learn and sufficient time for preliminary explanations, before discussing the approval agenda. In addition, we will work to increase opportunities to discuss business strategies and risks. Furthermore, we are considering conducting factory tours in Japan and visits to our overseas offices to promote understanding of outside directors on business details and business execution. We will also continue our efforts to improve governance by providing opportunities for regular meetings between outside directors, officers in charge, and senior vice presidents.

PDCA cycle for improving the effectiveness of the Board of Directors

Audit & Supervisory Board

The Audit and Supervisory Board is comprised of four auditors, including three outside auditors. In FY2024, the Board meeting was convened eleven times to receive reports on important audit-related matters and to discuss and resolve reported matters. The auditors also attended important meetings such as the Board of Directors meetings to audit and supervise the status of the directors’ performance of duties. They exchanged views with the representative director, senior vice presidents, and division heads twice during the year. The Audit and Supervisory Board also audited subsidiaries and factories in accordance with audit plans. Furthermore, the auditors worked to increase audit functions by regularly exchanging views with an independent auditor and the Internal Audit Division.

Appointment and Compensation Committee

The Appointment Committee, which is a voluntary committee comprised of the representative director and a majority of independent outside directors and chaired by an independent outside director, was convened three times in FY2024. In consultation with the Board of Directors, the Appointment Committee deliberates on matters pertaining to the election of candidates for directors and corporate auditors and reports the results of such deliberations to the Board. The Compensation Committee, which is a voluntary committee comprised of the representative director and a majority of independent outside directors and chaired by an independent outside director, was convened three times. In consultation with the Board of Directors, the Compensation Committee deliberates on the amount of compensation for directors and reports the results of such deliberations to the Board.

Strategies

Disclosure of corporate governance report

The Company submitted a report on corporate governance to the Tokyo Stock Exchange to disclose information on the status of our corporate governance. For more details, please refer to the Corporate Governance Report (PDF).

Strengthening IR activities

The Company is strengthening its investor relations activities to ensure timely and appropriate disclosure (information disclosure), transparency, and accountability to shareholders. In FY2024, we held 55 individual meetings with analysts and institutional investors to deepen their understanding of the Group’s management policies, global strategies, and capital policies. We also held two financial results briefings for institutional investors. Acting as a presenter, the Representative Director, Chairman & CEO provided a direct explanation to analysts and institutional investors regarding the Group’s financial summary, management policy, global strategy, medium-term three-year plan, capital policy, and other details. In addition, IR-related materials (in Japanese and English) were disclosed on the Company’s website to enhance information disclosure.

Indicators and targets

The Group’s track record includes the number of directors (including the percentage of independent outside

directors and the percentage of female directors), the number of Board of Directors meetings, the average

attendance rate at Board of Directors meetings (directors and corporate auditors), the number of Audit and

Supervisory Board meetings, and the average attendance rate at Audit and Supervisory Board meetings. In

FY2024, the Board of Directors held 12 meetings, with an average attendance rate of 99%.

For more details, please refer to the T. Hasegawa Group ESG Data Book (PDF).